Choosing the Right Installment Software for Housing Societies

When it comes to choosing the right installment software for housing societies, there are several factors that should be taken into consideration. Here are some key points to keep in mind.

- Ease Of Use: The software should be easy to use and understand, even for non-technical users. A user-friendly interface and clear instructions can make a big difference in ensuring that everyone in housing societies can use the software effectively.

- Customizability: Different housing societies have different requirements, so the should be customizable to meet the specific necessaries of the society. This can include features like customizable payment plans, automated billing, and integration with existing software.

- Security: The software should be secure and protect the sensitive data of the housing and it’s members. This can include features like data encryption, secure logins and regular backups.

- Cost: The cost of the FQMS Installment software should b reasonable and affordable for the housing societies. This include both upfront costs for purchasing the software as well as ongoing costs for maintenance and support.

- Customer Support: The FQMS Installment Software should offer reliable and responsive customer support to address any issues or questions that arise during the installation and use of the software.

Some popular options for installment software for housing societies in Pakistan include FQMS Installment software, Leasingsoftware.net and Installmentsoftware.net. It’s important to carefully evaluate the features and pricing of each option to determine which one is the best fit for your housing societies.

How Installment Software Can Transform How Housing Societies Operate

FQMS Installment software can transform how housing societies operate by streamlining the payment collection process, enabling easier financial management, and improving communication and transparency among members. Here are some specific ways in which installment software can bring about positive changes.

- Simplified Payment Collection: Housing societies often struggle to collect maintenance fees and other dues from members. This process can be streamlined with the help of FQMS Installment software that allows for automated payments, reminders and tracking of payments. This will reduce the administrative burden on the society, minimize the risk of errors and improved the overall efficiency of the payment collection process.

- Improved Financial Management: FQMS Installment software can provide societies with detailed financial reports and insights, help them to manage their finances more effectively. By providing real-time data on income and expenses, it can help societies to make informed decisions on budgeting, investments, and financial planning.

- Better Communication: Communication is key any community, and housing societies are no exception. FQMS Installment software can facilitate communication with among society members, allowing them to share updates, announcements, and feedback. This will help to create a more connected and engaged community, improving the overall quality of life in the society.

- Increased Transparency: Housing societies often struggle with transparency, particularly when it comes to financial matters. FQMS Installment software can help to increase transparency providing members with access to financial data, reports and updates. This will promote trust among members and create a more accountable and responsible society.

Overall, FQMS Installment software can transform how housing societies operate by simplifying payment collection, improving financial management, facilitating communication, and increasing transparency. By embracing this technology, housing societies can create more efficient, effective and collaborate that benefits all members.

Implementing Installment Software: What Housing Societies Need to Know

Housing societies can benefit from implementing software, which allows residents to pay their fees and dues in installments. Here are some things housing societies need to know implementing FQMS Installment software:

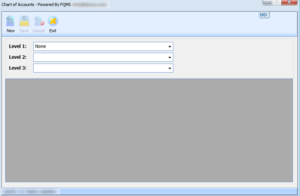

- Choose the Right Software: There are many FQMS Installment software choices available, so it’s important to choose one that is suitable for your housing societies necessary. Look for software that is user-friendly, secured, and can be easily integrated with your existing accounting software.

- Inform Residents: Once you have select the FQMS Installment software, inform your residents about the new payment method and how it use it. This can be done through email, newsletters or notices in common areas.

- Setup Payment Plans: The FQMS installment software allow you to setup different payment plans for residents, based on their preferences and financial situation. For example, you may offer monthly, quarterly or bi-annual payments.

- Ensure Security: Security is crucial when it comes to online payments. Make sure that the FQMS installment software is secure and complies with all relevant data protection laws.

- Monitor Payments: Keep track of all payments made through the FQMS Installment software and ensure that the payments are credited to the correct accounts. You may also send to reminders to residents who miss their payments.

- Provide Customer Support: Residents may have questions or issues when using the FQMS installment software, so it’s important to provide good customer support. This can be done through a dedicated helpline, customer support desktop team, WhatsApp, or online chat services.

By implementing FQMS installment software, housing societies can make it easier for residents to pay their fees and dues. It can also help to streamline the accounting process, making it more efficient and accurate.